- Oil and gas producers have relevant expertise

- Depleted oil and gas fields may be used

- Saudi and UAE have set targets

The Gulf’s geology and decades-old oil and gas industry could enable the region to become a world leader in carbon capture, utilisation and storage (CCUS), experts believe.

Gulf oil producers have been using carbon dioxide (CO2) capture technology for more than 40 years to remove the compound from natural gas before it is shipped for consumption.

As such, they have both the in-house expertise and the infrastructure to handle large volumes of CO2.

“Technology-wise, it’s not something that’s very challenging,” said Yvonne Lam, head of carbon and CCUS research at Rystad Energy in Oslo.

“Capturing CO2 at a gas processing plant, it’s low hanging fruit. The only difference is that you now need to transport and store the CO2.”

According to Lam, 90 percent of CO2 captured in the Gulf will be stored, nearly 10 percent deployed for enhanced oil recovery and a small portion becoming part of other products.

- Omani firm aims to rock the world by mineralising CO2

- Time to deploy the ‘silver bullet’ against climate change

- Mubadala Energy cuts CO2 by 41% in low carbon drive

“It depends on whether the products can permanently store the CO2,” said Lam.

Although carbon capture is a standard part of natural gas extraction, it is little used in the Gulf’s other heavy industries such as cement, steel and petrochemical production.

Policymakers must implement measures to drive CCUS deployment in these sectors, said Lam.

The Gulf’s three operational CCUS projects – one in each of Saudi Arabia, Qatar and the UAE – account for nearly 10 percent of CO2 captured globally, according to a report by the Global CCS Institute.

Qatar Gas captured 2.2 million tonnes of CO2 annually (mtpa) from its Ras Laffan gas liquefaction plant. Saudi Aramco and Abu Dhabi’s Adnoc each captured 0.8 mtpa from their Hawiyah Natural Gas Liquids plant and Al Reyadah projects respectively, the institute estimates.

As part of their Nationally Determined Contribution (NDC) climate action plans, the UAE, Qatar, and Oman have pledged to cut their carbon emissions by 40, 25, and 7 percent respectively by 2030 compared to the so-called business-as-usual scenario.

Carbon storage is likely to be an important component of achieving these targets.

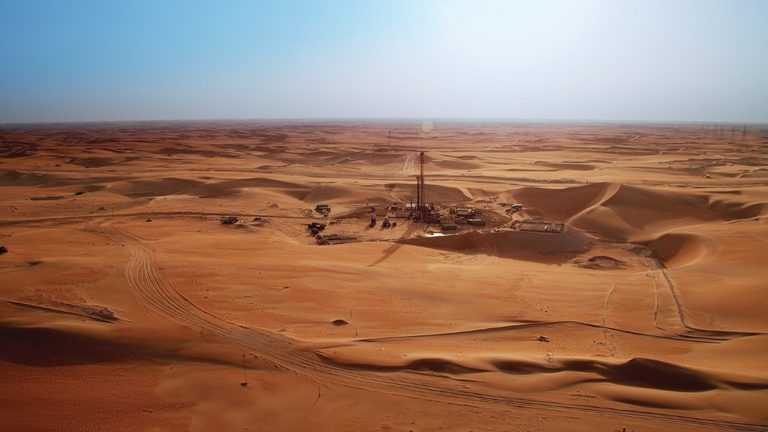

The Gulf is home to vast, depleted oil and gas fields whose geology is well documented.

They are ideal CO2 storage locations. Existing pipelines and injection wells can also be repurposed for CCUS, reducing costs and project completion times, according to a Rystad Energy report.

The Global CCS Institute offers a similar outlook, stating: “The GCC countries could be a world-class hub for carbon capture and storage.”

Rystad highlights “four potential CO2 storage hot spots” in the Gulf. These are Saudi Arabia’s giant Ghawar oil field, Qatar’s Dukhan field, and the UAE’s Bab and Northeast Bab fields and rock formations in the country’s Ruwais region.

Reuters

ReutersTargets

Adnoc aims to increase its CO2 capture capacity more than six-fold to 5 mtpa. It will be collected mostly from its gas processing plants, providing the same amount of carbon capture as a forest twice the size of the UAE, the company claims.

The energy giant’s Al-Reyadah plant launched operations in 2016, capturing CO2 emitted from production at Emirates Steel Industries, which it then injects into onshore oil fields.

Adnoc and United States’ Occidental on August 1 signed a “strategic collaboration agreement” to evaluate potential investments in carbon capture and storage hubs in the UAE and the US.

Saudi Arabia, meanwhile, aims to raise its CCUS capacity to 44 mtpa by 2035, according to a May 2023 report by The King Abdullah Petroleum Studies and Research Center. By the same year, the Gulf’s CCUS capacity will be 50 mtpa, Rystad Energy forecasts.

Such increases would represent a sizeable achievement. Global efforts to expand CCUS capacity remain far short of what is needed to slow climate change, however.

By 2030, such projects worldwide will extract around 550 million tonnes of CO2 from the atmosphere, Rystad forecasts, a ten-fold increase from the 2021 total of 45 mtpa.

Yet total global energy-related CO2 emissions hit a record 36.3 billion tonnes in 2021, according to International Energy Agency (IEA) figures, meaning CCUS removed less than 0.2 percent of these.

To be on schedule to achieve net zero by 2050, CO2 capture must reach 1.2 billion tonnes annually by 2030, the IEA says.

According to the Climate Accountability Institute, Adnoc was the world’s 13th largest carbon emitter for the period 1965 to 2020.

The company’s emissions, including Scope 3 from consumption of its oil and gas by third parties, totalled 16 billion tonnes of CO2-equivalent (tCO2e) – or an average of 291 million tonnes annually.

Saudi Aramco is the world’s biggest emitter of the greenhouse gas, causing 64.8 billion tCO2e over the same timeframe, including Scope 3 emissions, according to the institute’s data.

Currently, “the easiest, fastest and most impactful” method to persuade industry to deploy CCUS is to impose penalties for emissions or provide subsidies to build capabilities in it, Rystad’s Lam said.

This article appeared on Arabian Gulf Business Insight