Turki Al-Aqeel was a Senior Research Associate at KAPSARC. He has also worked in many national and multinational firms in Saudi Arabia and the United States in policy-related research, economic and market analysis, and electric power systems. His professional experience includes ABB, Woodward, Colorado Concept Coatings, and the Advanced Power Engineering Laboratory. Al-Aqeel holds a Ph.D. in Electrical Engineering, master’s degree in Business Administration from Colorado State University, and Graduate Certificates in Power and Energy, and Finance. Al-Aqeel is a Senior Member of IEEE and a Certified Modular Advanced Control (MACH2) Engineer for Flexible AC Transmission Systems. He has published several journal articles and conference proceedings in peer-reviewed journals and events and is a reviewer in several journals and conferences and a member of local and international committees.

Electricity Sector Liberalization in Egypt: Features, Challenges and Opportunities for Market Integration

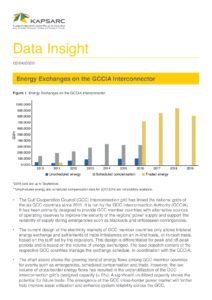

KAPSARC has initiated a research project to develop insights that can facilitate the establishment of a well-functioning integrated electricity market comprising the member states of the Gulf Cooperation Council (GCC). It aims to assess the key issues affecting electricity market integration within the GCC and wider Middle East and North Africa (MENA) region to produce insights and policy recommendations that facilitate market integration.

5th October 2020