Presenting India’s 2019 budget on July 5, Finance Minister Nirmala Sitharaman sketched out the Modi government’s vision of becoming a $5 trillion economy by 2024, almost doubling the country’s current gross domestic product (GDP) of $2.73 trillion. To achieve this ambitious goal, India plans to liberalize foreign direct investment (FDI) rules and tap international bond markets to fund its budget deficit. The latter is a risky enterprise and ensures exchange rate policy becomes a future battleground. However, India’s economic growth has been slowing over the past two quarters, and the government has limited options to raise funds domestically, forcing it to look at external foreign currency borrowing. The government is betting that external borrowing combined with FDI inflows will lead to greater domestic investment and thus higher growth.

Research Lead

Yagyavalk Bhatt is an energy professional with more than seven years of experience in the transportation and electricity domain. Yagyavalk…

Yagyavalk Bhatt is an energy professional with more than seven years of experience in the transportation and electricity domain. Yagyavalk leads “The Role of Clean Energy Policies: Trends in India’s Transport Sector” project, aimed at estimating India’s transport energy demand and potential impact on crude oil supply chain. His expertise covers energy policy, energy economics, transport modeling, the impact analysis of transport policies, emerging economies energy transition, renewable energy, and cost-benefit analysis of the transport and electricity sector. He has authored and contributed to numerous research papers and studies related to the transportation and electricity sector.

Expertise

- Policy Analysis

- Transport Demand Modeling

- Sustainable Transport

- Clean Energy Transition

- Renewable Energy

- Climate Change

Publications See all Yagyavalk Bhatt’s publications

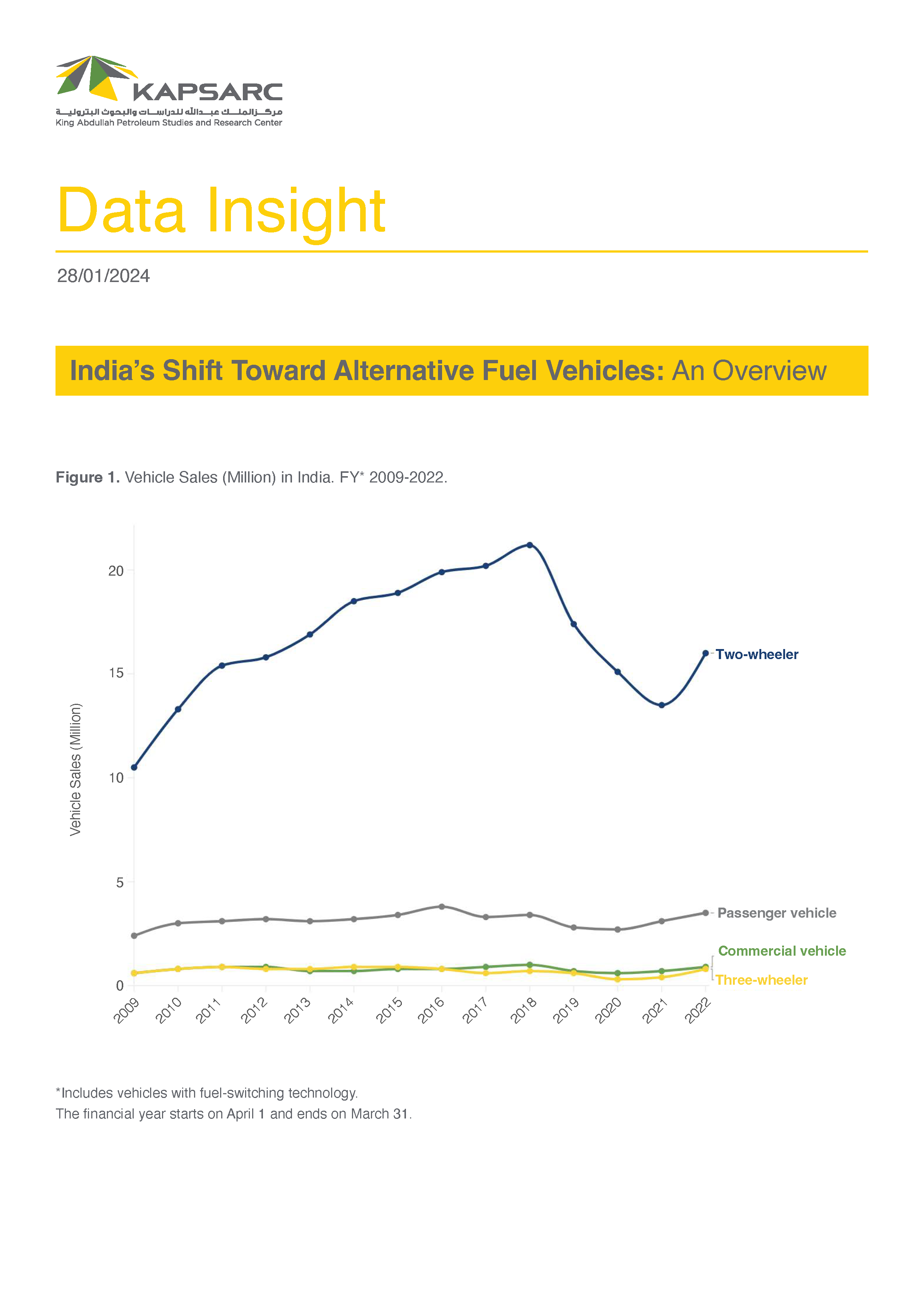

India’s Shift Toward Alternative Fuel Vehicles: An Overview

Presenting India’s 2019 budget on July 5, Finance Minister Nirmala Sitharaman sketched out the Modi…

30th January 2024

Smart Cities from an Indian Perspective: Evolving Ambitions

Presenting India’s 2019 budget on July 5, Finance Minister Nirmala Sitharaman sketched out the Modi…

15th October 2023