Filters

Publications

Assessing the potential of emerging CO2 utilization pathways in Saudi Arabia: A multi-criteria decision analysis approach

03 July 2025

Read More

5

Changing Tides - Strategic implications of the new draft IMO Net-Zero Framework for the maritime sector

30 June 2025

Read More

10

The road to double trouble: why doubling current energy efficiency progress is no easy feat

30 June 2025

Read More

10

Prospects for Sustainability in Riyadh’s Metro Connectivity

25 June 2025

Public transportation is essential for functional urban mobility, offering cost- effective, safe, and convenient commuting – especially in densely populated cities like Riyadh. Between 2019 and 2024, average peak-hour travel time within Riyadh increased by approximately 10%, accordin...

Read More8

Determinants of Sustainable Finance Flows: A Literature Review

25 June 2025

Sustainable finance has gained remarkable momentum over the past decade, but its global allocation remains uneven, with emerging market and developing economies (EMDEs) struggling to attract the capital required to meet ambitious climate targets. This shortfall threatens progress tow...

Read More9

Positioning Saudi Arabia’s Biogas Power Sector on the Global Stage: A Comparative Economic and Environmental Analysis

25 June 2025

Saudi Arabia is advancing a comprehensive framework to reduce greenhouse gas emissions through a range of strategies, including the displacement of liquid fuels, the implementation of energy efficiency measures, and the deployment of renewable energy technologies. To complement these...

Read More10

The Impact of LPG Adoption on Time Allocation, Employment, and Earnings in Kenya

25 June 2025

This study investigates how access to liquefied petroleum gas (LPG) affects time allocation, employment, and earnings in Kenya, using data from the country’s first nationally representative time use survey, Kenya Time Use Survey 2021 (KTUS) (Kenya National Bureau of Statistics 2023a)...

Read More8

The Impact of Variable Renewables on Price Dynamics Within Wholesale Electricity Markets

17 June 2025

The increasing integration of variable renewable energy sources introduces new complexities into electricity markets. This paper investigates their effects on price dynamics by utilizing unplanned wind power plant outages as exogenous shocks. Using data from the Turkish electricity m...

Read More9

Application of Global Optimization and Machine Learning Models to Refinery Programming

16 June 2025

aditional crude oil refinery production and economic models adopt linear approximations to facilitate linear programming applications for the purposes of operational planning, scheduling, and/or logistics to optimize product yields, margins, or other performance metrics of interest, ...

Read More4

The Response of Global Oil Inventories to Supply Shocks

16 June 2025

Read More

2

Analyzing The Interplay of Urbanization, Economic Development, and Seaborne Trade: Revealing Their Connection to Urban Resilience in Saudi Arabia

15 June 2025

Read More

6

Comparing the Latest 2024 Estimates of Methane Emissions for Saudi Arabia

11 June 2025

Methane is a very potent greenhouse gas (GHG) and the second-largest contributor to climate change after carbon dioxide (IPCC 2021). Over a 100-year period, 1 ton of methane can trap as much heat as almost 30 tons of carbon dioxide (IPCC 2021). Therefore, methane emission reductions ...

Read More8

Decarbonization Pathways for Asphalt Pavement Mixtures in Saudi Arabia: A Life Cycle Assessment Approach

11 June 2025

This study conducts a cradle-to-gate life cycle assessment (LCA) of asphalt mixtures in the Kingdom of Saudi Arabia (KSA). It focuses on assessing the environmental impacts of asphalt mixtures produced with and without reclaimed asphalt pavement (RAP), as well as the use of warm mix ...

Read More9

Assessing the Feasibility and Sustainability of Urban Air Mobility in Saudi Arabia

02 June 2025

Urban air taxis promise a revolution in transportation. However, the question of their immediate feasibility demands a complex answer, requiring a balance of technical capabilities, cost-effectiveness, operational efficiency, regulatory hurdles, and public acceptance. Urban air mobil...

Read More5

Life Cycle Environmental and Cost Analysis of SUVs: a Saudi Arabia Case Study

01 June 2025

Read More

4

A Perspective On Emerging Policy and Economics Research Priorities for Enabling Low-carbon Trucking

01 June 2025

Read More

4

Integrating Fairness Principles into Global Net-Zero Targets A Systematic Exploration of Fair Climate Policy

01 June 2025

Equity is a cornerstone of international climate policy, yet operationalizing “fair” burden-sharing remains challenging. Here we present a comprehensive effort-sharing framework that systematically spans a broad spectrum of principles, rather than limiting analysis to a few discrete ...

Read More7

January 2025, KAPSARC, in collaboration with the ELEVATE project funded by the European Union, conducted a “Co-Creation Workshop on National and Global Net-Zero Strategies.” The event brought together policymakers, industry professionals, think tanks, and academics to integrate scien...

Read More6

Aligning Urban Growth with Climate Goals: Emission Drivers and Policy Responses in Saudi Arabia’s Building Sector

27 May 2025

This study combines an econometric analysis and a Monte Carlo simulation to explore the drivers of carbon dioxide (CO₂) emission reductions in the Saudi building sector, with a particular focus on energy efficiency. Historical data from 1990 to 2022 are used to estimate the effects o...

Read More8

The Green Transition and Tech Firms’ Financial Performance: Insights from Patent Data

27 May 2025

The twin green and digital transitions are shaping the global business environment. However, academic research exploring the financial implications of the green-digital nexus remains limited. This paper explores the financial implications of a key mechanism within the green-digital n...

Read More5

Demand-side Modeling of Energy

22 May 2025

This entry gives a thorough overview of the concept of energy demand, including its forms and the different consumer groups associated with it. It outlines the theoretical underpinnings of how energy demand is shaped, and discusses the significance and j... Read full chapter here

Read More5

How Can LCA Inform ASI Strategies for Sustainable Mobility Transitions?

22 May 2025

Integrated approaches are vital for guiding sustainable mobility transitions, yet there is limited understanding of how life cycle assessment (LCA) can operationalize Avoid-Shift-Improve (ASI) strategies. This study explores the connections between LCA and ASI, demonstrating that LCA...

Read More9

Do Rising and Falling Oil Prices Affect Non-Oil Trade Balance Equally? Evidence from OPEC Countries

22 May 2025

This study investigates the effects of oil price changes on the non-oil trade balance in four major OPEC economies – the Kingdom of Saudi Arabia (KSA), Kuwait, Nigeria, and Venezuela – over the period 1982-2022. While oil revenues are a fundamental driver of economic activity in thes...

Read More4

Advancing Hydrogen in Saudi Arabia: Evidence-Based Insights from Stakeholder Engagement and Expert Survey

22 May 2025

Hydrogen technologies offer a promising pathway for reducing greenhouse gas emissions and advancing climate objectives globally. Integrating hydrogen into the Circular Carbon Economy framework is a strategic priority in the Kingdom of Saudi Arabia (KSA) to address climate and economi...

Read More4

Future Seaborne Exports and Their Impacts on Bunker Energy Demand: An Estimation of Saudi Container Seaports

22 May 2025

Seaports are crucial for facilitating maritime trade and integrating countries into the global economy. Understanding port business dynamics, including trade and the impact on bunker energy demand, is essential for a nation’s competitiveness. Saudi Arabia’s ports are strategically si...

Read More7

Improving Predictive Ability of Macroeconometric Models Using Coefficient Averaging

22 May 2025

approach to enhance KGEMM’s predictive ability. The framework includes the consideration of theoretically consistent estimates from single equation cointegration methods and Vector Autoregressive models for averaging after a set of prediction accuracy metrics widely used in empirica...

Read More7

Race to the Top: Harmonizing Regulations for Geological CO₂ Storage Under Article 6

20 May 2025

The urgent need to mitigate climate change underscores the importance of achieving reliable and widespread deployment of geological carbon storage. This discussion paper highlights the role of robust and harmonized state regulations in ensuring the environmental integrity of CO2 stor...

Read More5

Breaking Down Barriers: Emerging Issues on the Pathway to Full-scale Electrification of the Light-Duty Vehicle Sector

20 May 2025

A key pathway being considered worldwide to achieve net-zero greenhouse gas emissions in the light-duty vehicle (LDV) sector is the complete transition to electric vehicles (EVs). In this research, we assess potential barriers and challenges to fully electrifying the LDV sector. We u...

Read More6

Saudi Arabia’s Transport Sector in Transition: Life Cycle Perspectives

20 May 2025

Transportation is a fundamental driver of economic growth but also a significant contributor to environmental challenges such as air pollution and climate change. The Kingdom of Saudi Arabia (KSA) has set ambitious objectives to diversify and decarbonize its economy in order to achie...

Read More6

Inexpensive Renewable Electricity Enables Saudi Arabia’s Fuel Price Reforms

20 May 2025

Saudi Arabia is currently implementing fuel price reforms. The reforms are being executed in phases, where the ultimate goal is to have fuel prices approach their market equivalent values. Using the KAPSARC Energy Model, this analysis shows that such reforms would have been more cost...

Read More7

Competing in a Carbon-Constrained World: Exploring the Emerging Concept of Carbon Competitiveness

18 May 2025

The interplay between climate policies and economic competitiveness is increasing rapidly. In response, the concept of carbon competitiveness is emerging as a crucial factor that is shaping the future of global trade and climate action. The central challenge lies in balancing the nee...

Read More4

The Dynamics of Variable Renewable Energy Integration: A Multi-Dimensional Framework for Future Power Systems

18 May 2025

This paper examines the impacts of integrating a high share of variable renewable energy (VRE) on power systems and markets, proposing a multi-dimensional framework to analyze its technical, economic, and regulatory challenges. A structured literature review and topic modeling are em...

Read More6

Towards a Global Framework for Low-Emission Hydrogen: Certification and Trade in International Collaboration

18 May 2025

The international certification and trade of low-emission hydrogen are critical for decarbonizing hard-to-abate sectors such as heavy industry and transportation. However, fragmented regulatory frameworks across jurisdictions pose significant barriers to scaling global trade and inve...

Read More2

Financing the Decarbonization of Hard-to- Abate Sectors Trends, Issues, and Ways Forward

18 May 2025

The decarbonization of hard-to-abate sectors, such as steel, cement, petrochemicals, and heavy transportation, is essential to achieving global net-zero targets and maintaining financial stability. Despite a significant increase in global transition... Read Full Book Chapter Here

Read More8

Decarbonizing Saudi Arabia’s Transportation: Insights from LCA Case Studies

05 May 2025

The transport sector is vital to Saudi Arabia’s socioeconomic landscape, yet it contributes approximately 22% of the nation’s total greenhouse gas (GHG) emissions. As the Kingdom diversifies its economy beyond the oil sector, adopting sustainable transport solutions is essential for ...

Read More5

Integrating Life Cycle Assessment and Avoid-shift-improve Frameworks for Sustainable Mobility Transition in India

01 May 2025

Read More

3

Climate Change and Carbon Policy: A Story of Optimal Green Macroprudential and Capital Flow Management

01 May 2025

Read More

5

Toward AV-CAV Deployment in the Kingdom of Saudi Arabia: A Readiness Assessment Based on Expert Feedback

29 April 2025

Read More

4

The “Resolutionary” Shift: The EU’s Transition to 15-Minute Clearing in Day-Ahead Electricity Markets

27 April 2025

In an effort to enhance grid stability, support the deployment of renewable energy, and improve overall electricity market performance, the European Union (EU) is preparing to implement a significant change – the introduction of a 15-minute Market Time Unit (MTU) across its interconn...

Read More4

Are There Adequate Materials and Land Resources for the Saudi Power Sector to Achieve Net Zero by 2060?

27 April 2025

Saudi Arabia has committed to net-zero (NZ) greenhouse gas emissions by 2060. This requires substantial emission reductions across key sectors, including the power generation sector. We assess the technological options, critical mineral requirements, renewable energy resource require...

Read More7

Myths and Mysteries About Speculation in the Oil Market

27 April 2025

The article provides unique quantitative insights about highly secretive and poorly understood speculation in the oil market. To demystify the behavior of speculators, we look at the problem from five different angles. First, we explain how the presence of large over-the-counter (OTC...

Read More7

Cross-Border Electricity Trading in the GCC Countries, Egypt, Jordan and Iraq: Hourly Market Coupling or Bilateral Agreements?

26 April 2025

Read More

3

The Green Transition and Tech Firms' Financial Performance: Insights From Patent Data

23 April 2025

Read More

0

Toward Autonomous and Connected Autonomous Vehicle (AV-CAV) Deployment in Saudi Arabia: A Readiness Assessment Based on Expert Feedback

21 April 2025

The deployment of autonomous vehicles (AVs) and connected autonomous vehicles (CAVs) presents significant opportunities to transform urban mobility, reduce emissions, and enhance transportation efficiency. This study evaluates the readiness of the Kingdom of Saudi Arabia (KSA) for AV...

Read More39

Advancing Plastic Waste Recycling in the GCC: Policies, Technologies, and Economic Opportunities

21 April 2025

This report aims to provide a comprehensive analysis of plastic waste disposal, recycling rates and the recycling infrastructure gaps in the GCC countries, along with encouraging policies to capture the untapped potential of the recycling sector, and transition from current disposal-...

Read More27

Emerging Policy and Economics Research Priorities for Enabling Low-Carbon Trucking

16 April 2025

Trucking plays a crucial role in sustaining economic activity worldwide, yet its current path of carbon emissions is out of sync with the net-zero goals set by governments globally. As a result, identifying key energy economic and policy research priorities for low-carbon trucking has...

Read More28

Limiting Carbon Dioxide Removal Could Exacerbate Global Economic Inequality

16 April 2025

The Paris Agreement’s goal of limiting global warming to well below 2 degrees Celsius (°C), and ideally 1.5°C, above pre-industrial levels, places significant emphasis on carbon dioxide removal (CDR) technologies. However, the global landscape for CDR deployment remains uneven, with s...

Read More29

Resilience in Transition: Skills in a Decarbonizing Labor Market

10 April 2025

To better measure job resilience, we use the Transition Risk Index (TRI), which combines sectoral carbon exposure, occupational adaptability, and labor market frictions. Between 2019 and 2022, Saudi Arabia’s TRI improved significantly. With the right policies—sh... Read Full Report Here

Read More5

The Fast Uberization Trend in China’s Road Freight Transport Sector

08 April 2025

Road freight transport is a leading oil consumer and one of the most hard-to-abate sectors (IEA 2017; McKinnon 2018). In most developing countries, the sector is characterized by excessive market fragmentation, where the majority of the market supply is from small carriers, such as o...

Read More8

Ground-Source Air Conditioning: A Potential Solution for Saudi Arabia’s Building Sector

08 April 2025

Energy consumption for cooling in Saudi Arabia is notably high due to the country’s extreme climatic conditions, with air conditioning accounting for a significant portion of electricity demand. Addressing this challenge requires innovative solutions that align with Saudi Arabia’s Vi...

Read More10

Costs of Switching Fuels and Manufacturing Processes for Construction Materials Companies in Saudi Arabia

05 April 2025

Read More

4

Evaluating Hypothetical Carbon Pricing for Saudi Arabia Using a Macroeconometric Modeling Framework

02 April 2025

Read More

7

The Rapid Expansion of Battery Energy Storage: Why the Saudi Market Is Booming

27 March 2025

Saudi Arabia has embraced utility-scale battery storage to the extent that it now ranks third globally in announced battery storage energy project capacities at 22 gigawatt-hours (GWh), behind only China and the United States (U.S.), and it aims to achieve 48 GWh of battery energy st...

Read More11

Does integrating oil refining with petrochemicals provide long-term benefits for Saudi Arabia?

25 March 2025

To integrate or not to integrate petrochemicals – that is the question posed by this paper for Saudi Arabian oil refineries. The viability of combining domestic oil refining and petrochemical activities is investigated using an energy system model for Saudi Arabia. Two scenarios are ...

Read More9

Decarbonizing Saudi Arabia energy and industrial sectors: Assessment of carbon capture cost

25 March 2025

The global drive for net-zero emissions has highlighted carbon capture, utilization, and storage (CCUS) as a critical tool to reduce CO2 emissions from energy and industrial sectors. Achieving climate goals necessitates a comprehensive understanding of regional CO2 emission profiles ...

Read More6

Saudi Arabia needs to decarbonize road freight transportation to fulfill its emission reduction commitments. In this study, we utilize the GCAM-KSA modeling framework to explore potential mitigation pathways for the Kingdom’s road freight sector. We evaluate the emission implications...

Read More6

Opportunities From Saudi Mineral Resources – A Domestic Supply Perspective

21 March 2025

Saudi Arabia’s mineral sector, long recognized as the third pillar of its economy alongside oil and petrochemicals, is becoming increasingly vital due to the global demand for minerals essential for the clean energy transition. Understanding the domestic and international implication...

Read More8

Energy Stewardship in a Transitioning World: Extending the Hydrocarbon Value Chain into Lithium Extraction in Saudi Arabia

21 March 2025

Energy security has long been central to the strategic and policy frameworks of governments worldwide, owing to the indispensable role of stable and sufficient energy supplies in underpinning economic growth, social welfare, and political stability. Historically, the pursuit of energ...

Read More8

Progress and Gaps in the Adoption of Clean Cooking Fuels in Africa – Policy Options for Ghana and Kenya

13 March 2025

Access to clean cooking fuels is vital for public health, environmental sustainability, and socio-economic development in sub-Saharan Africa. This study examines the key barriers to adopting clean cooking fuels in Ghana and Kenya, asking. Despite progress in urban areas toward liquef...

Read More8

Exploring Contractual Arrangements for Electricity Trading in the Middle East

09 March 2025

The Gulf region is undergoing an energy transition, and the electricity sector is crucial to its success. Since 2001, the region’s interconnections have allowed electricity trade among the Gulf Cooperation Council (GCC) countries. Its continued interconnection expansion within the GC...

Read More8

Carbon Markets and Saudi Arabia: A Review of Options and Analysis of Carbon Crediting Potential

09 March 2025

In response to the growing interest in carbon markets in Saudi Arabia, KAPSARC implemented a study to better characterize and understand the potential for carbon crediting in the Kingdom. The focus was specifically on providing estimates of the potential for supply and demand of carbo...

Read More7

Pandemic, Ukraine, OPEC+ and Strategic Stockpiles: Taming the Oil Market in Turbulent Times

09 March 2025

Read More

6

The Transportation, Housing, and Energy Implications of New Murabba Analysis and Forecast Using a Spatial Economic Time Series Simulation Model

04 March 2025

New Murrabba is a proposed megaproject involving residential, office, and retail development in Riyadh, Saudi Arabia. This project would encapsulate a portion of the expected rapid growth in the city into a unique and visionary development.

Read More7

Analysing the Role of Energy in Economic Growth and Convergence: A Cross-country Study from 1980–2019

25 February 2025

Read More

5

Breaking Down Gasoline and Diesel Prices: The Role of Taxes, Oil, and Other Components

24 February 2025

There is a common belief that fluctuations in gasoline and diesel retail prices are primarily driven by changes in oil prices (Bumpass, Ginn, and Tuttle 2015). While this is partly true, the fact is that gasoline and diesel prices are influenced by multiple components, which can redu...

Read More6

Assessing ESG Impact in the Oil and Gas Industry: A Multi-Criteria Approach

24 February 2025

The paper titled “Assessing ESG Impact in the Oil & Gas Industry: A Multi-Criteria Approach” discusses the critical role of environmental, social, and governance (ESG) principles in the oil and gas sector, highlighting both challenges and opportunities. The document e...

Read More7

Net-Zero Transition and Employment in Saudi Arabia’s Energy Sector

24 February 2025

Saudi Arabia has engaged in a deep transformation of its hydrocarbon-based domestic energy system. The shift is in line with the country’s Nationally Determined Contribution commitment to reduce emissions by 278 million tons below a baseline by 2030, and ... Read full report here

Read More10

Saudi Arabia’s National Greenhouse Gas Emission Inventories: Overview, Progress, and Outlook

11 February 2025

This paper summarizes Saudi Arabia’s history with national greenhouse gas emission reporting, giving an overview and discussing the trends in emissions.

Read More8

Assessing CO2 Emissions from Commercial Aviation in Saudi Arabia: A Methodological Approach

11 February 2025

Aviation is projected to grow in the coming decades, leading to increased fuel consumption and greenhouse gas emissions, despite advancements in efficiency. As other sectors decarbonize, aviation’s impact on climate change may become more significant. Assessing aircraft perform...

Read More8

Alternative Fuels and Processes for Saudi Construction Materials Companies

11 February 2025

Producing construction materials requires a great amount of energy, and in Saudi Arabia, this production currently entails the use of substantial amounts of liquid fuels. Liquid fuels are mostly sold at below-market prices domestically, and thus result in large opportunity costs for...

Read More9

The Potential Role of Truck-Hailing and Operational Efficiency Improvement in Decarbonizing China’s Medium- and Heavy-Duty Road Freight Transport

11 February 2025

Truck-hailing is a relatively new Uber-like business model that connects road freight carriers with shippers via mobile apps. First appeared around 2013, it has achieved fast market uptake in China, involving almost 8 million commercial trucks annually by the end of 2023. With China ...

Read More6

Energy Peacekeeping: The Role of Effectivités as a Viable, Legal Instrument in Addressing Shared or Disputed Offshore Oil and Gas Fields

11 February 2025

As more offshore oil and gas discoveries, some of them dramatic, take place in areas where maritime boundaries can be disputed, effectivités have become key considerations in resolving some of the resulting conflicts. A basic understanding of the theory of effectivités is therefore v...

Read More6

Energy Transition in Oil-Dependent Economies: Public Discount Rates for Investment Project Evaluation

05 February 2025

For an oil-exporting economy, valuing oil-related cash flows from a public perspective requires using a discount rate equal to the risk-free public rate plus a risk premium. Economic dependence on oil affects the public discount rate for oil-related cash flows in two opposite ways: o...

Read More6

The Role of the Petrochemical Sector's Exports in the Diversification of the Saudi Economy. A Scenario Analysis of the Foreign and Domestic Price Shocks

04 February 2025

Read More

65

Macroeconomic and Sectoral Effects of Natural Gas Price: Policy Insights from a Macroeconometric Model

04 February 2025

Read More

63

Concrete: The Non-Critical, Critical Material

02 February 2025

The paper is a commentary on key questions facing the relationship between concrete, the energy transition and the global move to net-zero.

Read More82

Why Chinese Car Owners May Not Repurchase Electric Vehicles?

01 February 2025

Read More

4

Ratifying the Kigali Amendment Challenges and Opportunities for Saudi Arabia

23 January 2025

The Kigali Amendment to the Montreal Protocol is an international agreement which continues the effort to protect the ozone layer but adds the phase out of hydrofluorocarbons (HFCs), potent greenhouse gases that contribute significantly to global warming. The international efforts on...

Read More47

Evaluating Airport Location Sustainability Performance: A Methodology from Experts and Contextual Perspective

23 January 2025

This paper presents a methodology to evaluate the sustainable performance of an airport location. The approach integrates multiple criteria, including transport requirements, environmental impacts, accessibility, economic potential, social impacts, and regulatory acceptability. The m...

Read More79

Waste-to-Hydrogen Techno-Economic Assessment and Emission Reduction Potential in Saudi Arabia

23 January 2025

Waste-to-hydrogen (WTH) presents an enormous untapped potential to achieve climate change objectives for many countries by transitioning from high CO2 emission waste disposal techniques to producing clean fuel such as green hydrogen. Additionally, WTH can be incorporated with carbon ...

Read More38

Windfalls and Pitfalls: How Foreign Labor Strengthens Economic Resilience in GCC During Energy Transition

20 January 2025

Governments in oil-dependent countries, particularly those in the Gulf, have launched broad and ambitious national plans to diversify their economies. While diversification reduces vulnerability to oil shocks, the expansion of renewables and the deregulation of domestic energy prices...

Read More35

The Potential Role of Seasonal Pumped Hydropower Storage in Decarbonizing the Power Sector in Saudi Arabia

16 January 2025

Read More

32

Designing Long-lasting Inventions for Residential Energy Efficiency

15 January 2025

Read More

34

Assessing Impacts of Global Economic Dynamics on the Saudi Economy and Oil Production: A GVAR Analysis

14 January 2025

Read More

26

KAPSARC Oil Market Outlook (KOMO)

13 January 2025

This is the KAPSARC Oil Market Outlook quarterly report that focuses on oil markets supply, demand and balances.

Read More28

A Review Approach to Understanding the Current Status of Port Resilience: Lessons Learned for GCC Ports

12 January 2025

Read More

30

A Maritime Sector in Transition – The Role of Saudi Arabia

12 January 2025

The maritime sector currently accounts for approximately 2.3% of global CO₂ emissions, with forecasts suggesting that this figure could rise to 10%-13% by 2050 (IMO 2023). This significant increase emphasizes the pressing need for decarbonization to mitigate environmental risks. This...

Read More35

Does the Income Elasticity of Energy Demand Vary with the Stages of Economic Development?

12 January 2025

This paper revisits the empirical evidence on the income elasticity of energy demand by investigating whether it varies with the level of economic development. Our analysis, based on a sample of 111 countries spanning three decades, reveals that the elasticity is not constant a...

Read More80

Roadmap for Carbon Capture, Utilization, and Storage (CCUS) in Saudi Arabia Insights From Stakeholder Engagement and Expert Survey

12 January 2025

This paper presents the findings of a survey conducted by KAPSARC, focusing on the role of Carbon Capture and Storage (CCS) technology within the framework of Circular Carbon Economy (CCE). The survey, part of the CCE Roadmaps project, aimed to gather insights from diverse stakeholde...

Read More35

Decarbonizing Land-Based Passenger Transport in Saudi Arabia

12 January 2025

The Saudi government has outlined its decarbonization strategy through various statements and reports, identifying key initiatives, preferred technologies, and investment targets to drive this transformation. In this study, we employ Integrated Assessment Modeling (IAM) to evaluate t...

Read More36

Climate-Resilient Cities: Priorities for the Gulf Cooperation Council Countries

12 January 2025

This edited volume discusses the concept of resilient cities within the Gulf Cooperation Council (GCC) region. Written by an international panel of scholars and experts, the book presents theoretical approaches, identifies risk factors, and suggests policie... Read Full Book Here

Read More35

Sectoral Clustering and Climate-Tech Startup Financing Through Venture Capital and Private Equity

12 January 2025

In this study, I investigate climate-tech startup financing of venture capital (VC) and private equity (PE) investments across different sectors around the world for the 2022-2024 period. Cross-sectional analysis suggests that start-ups in sectors with higher dynamism (proxied by dea...

Read More30

Technoeconomic Assessment and Carbon Dioxide Removal Potential for the Global Pulp and Paper Industry

12 January 2025

The pulp and paper industry is the fourth largest industrial energy user globally and presents significant carbon removal potential as a large portion of emissions from this industry are biogenic. The decarbonization potential of this industry has been discussed in literature at coun...

Read More33

Modeling the Impact of Price and Usage Efficiency on Domestic Water Demand in Saudi Arabia

09 January 2025

Read More

4

In May 2023, the King Abdullah Petroleum Studies and Research Center (KAPSARC) organized a workshop titled “The race to decarbonize long-haul transport and the lessons learned for KSA” with the support of the University of Antwerp. The workshop aimed to discuss current developments i...

Read More26

Anticipating Trend Shifts in Oil Prices Using the Crude Oil Storage Index

07 January 2025

We analyze oil price dynamics in the long-, medium and short-term by using the world crude storage index (COSI), a global index reflecting spread options values from crude oil at major ports around the world for all of the major competing crudes.

Read More34

No Magic Bullet The Challenge of Security Interventions in Phantom Oil Flows

07 January 2025

The discovery and exploitation of oil and gas significantly transformed the global economy and social welfare landscape. Oil, in particular, became the lifeblood of industrialization, fueling the growth of numerous sectors, including transportation, manufacturing, and electricity gen...

Read More30

The Determinants of Successful Energy Subsidy Reforms: A Logistic Regression Analysis

29 December 2024

Many factors influence whether an energy subsidy reform is successful. We define success as a reform that does not lead to social unrest and is not reversed. To better understand these factors, we apply logistic regression analysis to an original dataset capturing 392 distinct episod...

Read More27

Harnessing Heat from the Refinery and Petrochemical Sectors for Future Commercial-Scale DAC Systems in Saudi Arabia

29 December 2024

As the global community commits to achieving net-zero carbon emissions, innovative strategies such as Direct Air Capture (DAC) are gaining prominence. DAC, a key carbon dioxide removal (CDR) technology, is energy intensive and requires large amounts of heat and electricity. To ensure...

Read More31

Navigating the Trade and Climate Change Nexus

19 December 2024

As global efforts to tackle climate change intensify, the intersection of trade and climate policy is increasingly critical. Trade can drive access to clean energy technologies and promote sustainable practices but also risks amplifying emissions through carbon-intensive industries a...

Read More33

Impact of Urban Traffic on Fuel Consumption Leveraging IoT Data: Case Study of Riyadh City

19 December 2024

This study explores the rising trend of traffic congestion in Riyadh and its impact on fuel consumption for passenger cars amid the challenges of rapid urbanization and increasing vehicle use. By utilizing real-time floating car data (FCD) collected by vehicles equipped with Global P...

Read More42

The Economics of Offshore Wind-Based Hydrogen Production in Saudi Arabia

18 December 2024

Offshore hydrogen production from offshore wind energy is gaining global attention as an appealing solution for scaling up green hydrogen production. The technoeconomic feasibility of integrating offshore wind into hydrogen production has been explored in various regions, but no comp...

Read More30

Analyzing the Interplay of Urbanization, Economic Development, and Seaborne Trade A Case of Saudi Arabia

18 December 2024

Urbanization is widely recognized as a critical factor influencing economic growth and global trade, yet there is ongoing debate about whether it drives these outcomes or is a consequence of them. To address this, it is essential to determine whether urbanization spurs economic devel...

Read More35

Environmental Performance of Passenger Cars in the KSA: Comparison of Different Technologies via a Life Cycle Assessment Approach

18 December 2024

In terms of deployment feasibility, PHEVs and HEVs have a distinct advantage over FCEVs, as they can leverage the existing electricity grid and fueling infrastructure, making them a more practical and readily available solution for reducing near-term emissions in the KSA transportat...

Read More33

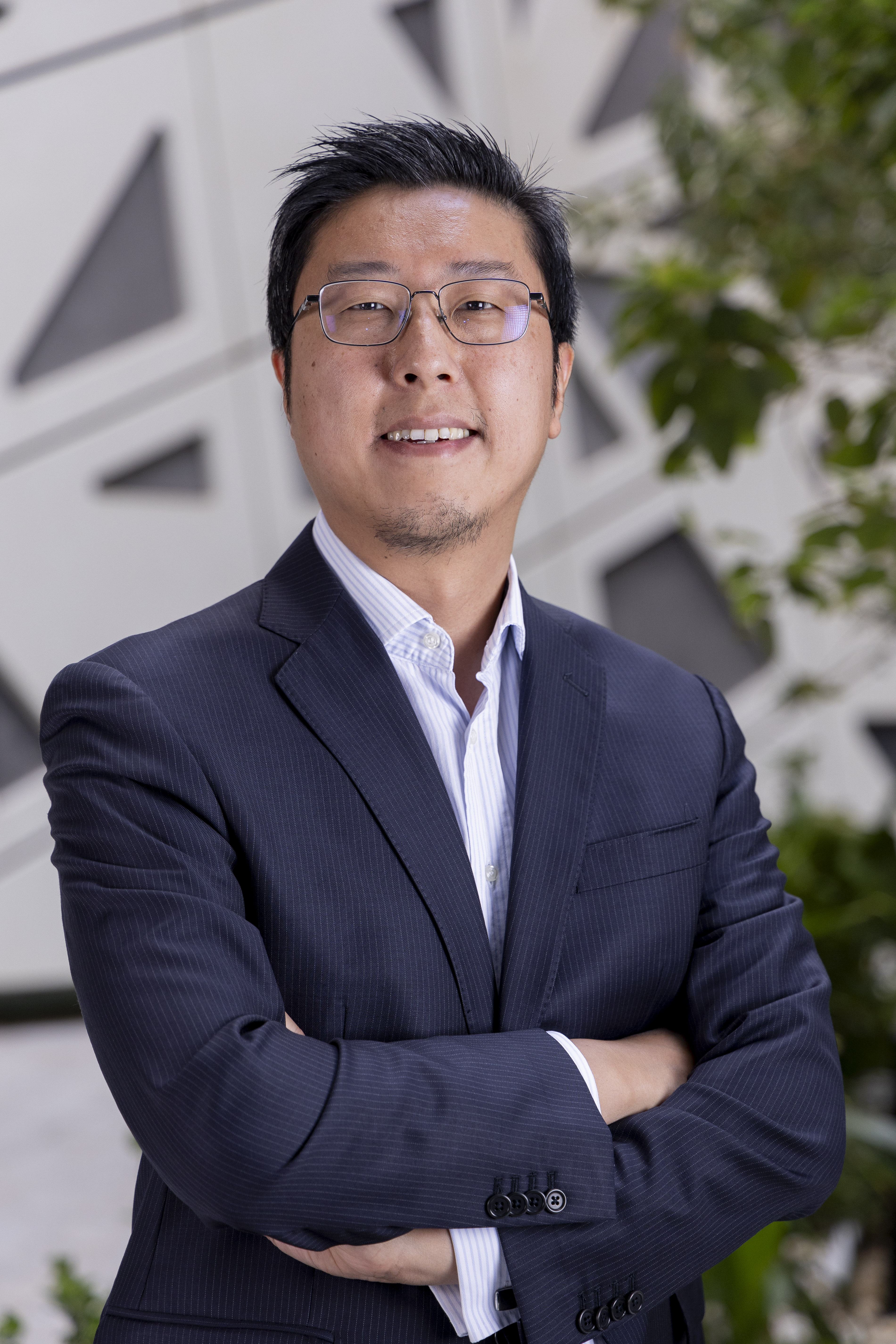

Electric Vehicle Battery Chemistry Evolutions: Critical Mineral Implications

18 December 2024

The energy and transport transition will require a wider volume and range of materials than the systems that it is replacing. This has become an increasingly important topic across both the government and private sectors over the last decade. A crucial component of this materiality i...

Read More35

Carbon Dioxide Utilization in the Desalination Sector in Saudi Arabia: An Opportunity for Achieving Negative Emissions

18 December 2024

The global pursuit of sustainable solutions to mitigate climate change has intensified, necessitating innovative approaches that transform traditional carbon-intensive industries into potential carbon sinks. Carbon capture, utilization and storage (CCUS) is a key tool for achieving n...

Read More29

Carbon Removal Ratings and their Potential in Saudi Arabia

18 December 2024

As the global focus on mitigating climate change intensifies, carbon dioxide removal (CDR) technologies have emerged as critical tools in reducing atmospheric carbon levels. In Saudi Arabia, recent studies have identified direct air capture (DAC) and energy from waste with carbon cap...

Read More31

Uncertainty in Modeling the Demand for Materials from the Energy Sector at a Country-level: A Case Study of Saudi Arabia

12 December 2024

The material intensity of the energy transition has been a topic of growing importance in the literature and policymaking over the last decade. Much of this debate has been founded on a range of future demand forecasts of the material requirements of the energy transition, primarily ...

Read More36

How to Create a Hydrogen Market? Lessons from Electricity and Gas Markets on Pricing and Investment Approaches

12 December 2024

To promote low-carbon hydrogen, which is produced in a way that results in no or near-zero greenhouse gas (GHG) emissions, for decarbonization, substantial investments are required across the hydrogen value chain. Despite the potential of hydrogen in several applications, various unc...

Read More34

Life Cycle Assessment (LCA) Framework for Examining the Environmental Impacts of Asphalt Pavement Mixtures in Saudi Arabia

12 December 2024

Energy consumption and transport distance (i.e., the distance between raw... Several environmental impact categories, including stratospheric ozone depletion, photochemical ozone formation, acidification, eutrophication, climate change, and particulate matter formation, were identified.

Read More44

Towards a CCS National Strategy and Roadmap for Saudi Arabia

09 December 2024

Saudi Arabia, the world’s largest oil exporter, has long been associated with the production and consumption of hydroacrbons. However, with the increasing concerns over climate change and the urgent need to reduce greenhouse gas emissions, the country has started to explore and inves...

Read More41

A Maritime Sector in Transition – Learning from Other Sectoral Energy Transitions

09 December 2024

The maritime sector currently contributes approximately 2.3% of global CO₂ emissions, with projections suggesting that this share could rise to 10%-13% by 2050, highlighting an urgent need for decarbonization. In response to the potentially catastrophic impacts of climate change, the...

Read More32

Life Cycle Assessment of Road Freight Decarbonization in Saudi Arabia

09 December 2024

The Kingdom of Saudi Arabia (KSA) is committed to transitioning towards a diversified, low-carbon economy, necessitating the decarbonization of its road freight sector, which is a significant source of domestic energy consumption and greenhouse gas (GHG) emissions. This study address...

Read More37

BRICS+ and the Future of Commodity Markets

05 December 2024

The dissolution of the Soviet Union in late 1991 marked a pivotal shift in the global economic landscape, ushering in an era characterized by increased market openness and economic integration. The years following have been symbolized by the formation of the European Union in 1993 an...

Read More36

Empowering Change: Overcoming Obstacles in Implementing CCS for Power Generation – Key Takeaways for Global Players

03 December 2024

Ac...2emissions, which come primarily from the combustion of fossil fuels, reached a record high level of 37.4 gigatonnes (Gt) in 2022 (IEA 2024). At 38% electricity generation continues to be the largest contributor to these emissions, despite the impressive growth in renewable energy.

Read More27

Locating EV Charging Stations to Enable Intercity Travel in Saudi Arabia

03 December 2024

The development of electric vehicle (EV) infrastructure presents a promising pathway to reduce transportation emissions, particularly when integrated with low-carbon energy systems. Given Saudi Arabia’s commitment to sustainable travel initiatives, a clear understanding of the ...

Read More44

Behavioral Changes in Household Electricity Consumption from 2015 to 2022

02 December 2024

Analyzing the distribution of electricity consumption provides a clearer picture of distinct household segments and their behaviors. This approach allows us to identify clusters of low, moderate, and high consumers, offering insight into usage patterns. Such granularity can guide tar...

Read More28

Key Drivers of Decarbonizing Hard- to-Abate Energy- System Sectors by Midcentury

02 December 2024

o limit global warming to 1.5°C or 2°C, achieving a net-zero or near-zero greenhouse gas emission energy system by midcentury is essential. This ambitious target requires the decarbonization of hard-to-abate sectors, particularly transportation and heavy industry. This study employs ...

Read More35

Introduction of Electric Vehicles in Saudi Arabia: Impacts on Oil Consumption, CO2 Emissions, and Electricity Demand

02 December 2024

emissions associated with the road transport sector by 2050. On the basis of the projected number of ICE vehicles, we design three scenarios for developing electric vehicles (EVs) (high-, moderate-, and low-growth scenarios) to determine the impact...2emissions, and electricity demand.

Read More33

Balancing International Trade and Climate Justice: Legal Perspectives on the EU’s Deforestation Regulation

02 December 2024

Forests play a crucial role as natural carbon sinks and protectors of biodiversity. According to the Food and Agriculture Organization (FAO) of the United Nations, the world lost approximately 4.2 million square kilometers of forest between 1990 and 2020 – an area nearly twice the si...

Read More27

Phantom Oil Movements: An Investigation into Opaque Ship- to-Ship Operations and Their Role in Sanction Evasion

02 December 2024

The transportation and distribution of large volumes of oil, gas, and refined products over long distances are enabled primarily by marine shipping. Transborder pipelines serve as an additional method for transporting oil and gas. However, these pipelines are typically more expensive...

Read More33

Approach and Initial Findings in Modeling Future Seaborne Trade and Its Impact on Energy Demand

26 November 2024

) emissions, prompting the International Maritime Organization (IMO) to aim for net-zero shipping greenhouse gas (GHG) emissions by 2050 to mitigate climate change. Shipping is a critical link between countries for transporting goods, and its future advancements will hinge primarily ...

Read More35

Digitalized Virtual Power Plants to Unlock the Value of Distributed Energy Resources in the Day-Ahead Market

26 November 2024

Digitalized virtual power plants (DVPPs) are advanced software platforms that aggregate and optimally orchestrate a collection of distributed energy resources (DERs) to support grid balance and stability to alleviate stressed transmission and distribution lines and provide critical g...

Read More35

Resilient Digitalized Power Grids with High Penetration of Distributed, Variable Renewable Energy

25 November 2024

Conventional power grids are undergoing a transition towards digitalized power grids, where cyber, physical, and social domains are tightly coupled through smart components, advanced metering infrastructure, wireless communication /connectivity networks, and digital technologies that...

Read More28

How the Census-2022 Results Changed the Outlook for Electricity Demand

25 November 2024

This paper aims to address these discrepancies by reestimating an original empirical model of electricity demand using recently revised population data from GaStat (2024). The original model, which was developed by Mikayilov and Darandary (2024), relied on population data from GaStat...

Read More27

Export Destination and Firm Upgrading: Evidence from Spain

20 November 2024

Read More

30

Inter-fuel Substitution in the Industrial Sector of Saudi Arabia

15 November 2024

Read More

30

The Circular Carbon Economy Index 2024 – Results

14 November 2024

The 2024 CCE Index provides a multidimensional overview of the current state of net-zero transitions worldwide, covering 125 countries from all world regions. It is based on the holistic, technology-neutral and flexible concept of the circular carbon economy (CCE), where a full CCE i...

Read More35

Pandemic, Ukraine, OPEC+ and Strategic Stockpiles: Taming the Oil Market in Turbulent Times

12 November 2024

With a simple decomposition method, we estimate the monthly shifts in global oil demand and non-OPEC+ supply since 2010. We find evidence that during the January 2017 to December 2023 period, OPEC+ attempted to stabilize the price of crude oil well below the values assessed by market...

Read More32

Why Does Sustainable Finance Not Flow into the Global South?

12 November 2024

While private sustainable finance flows have grown substantially in recent years, they are heavily concentrated in certain countries – primarily in a few advanced economies. Emerging markets and developing economies (EMDEs) face significant barriers to accessing much-needed private f...

Read More28

Unlocking Energy Efficiency in the GCC Built Environment

12 November 2024

The Gulf Cooperation Council (GCC) region, encompassing Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, is distinguished by rapid urbanization, robust economic growth, and substantial energy consumption. The built environment has expanded significantly to ac...

Read More31

Does the Income Elasticity of Energy Demand Vary with the Stages of Economic Development?

12 November 2024

Read More

41

The Life Cycle Greenhouse Gas Emissions Assessment of Jet Fuel Production and Consumption

12 November 2024

This paper aims to estimate the life cycle greenhouse gas (GHG) emissions of jet fuel production and consumption in the Kingdom of Saudi Arabia (KSA) using the life cycle assessment (LCA) methodology. The system boundaries include well-to-tank (WTT) activities, covering crude oil ...

Read More33

Critical Minerals and the Oil Industry: The Impact of a Positive Shock to Critical Mineral and World Oil Prices

07 November 2024

The term “critical minerals” (CMs) refers to a distinct category of commodities, such as rare earths, critical earth minerals, and other non-fuel minerals or mineral materials that are of strategic importance to national economies and technical development and that have a high risk o...

Read More29

Enabling Net-zero Shipping: An Expert Review-based Agenda for Emerging Techno-economic and Policy Research

06 November 2024

Read More

29

A Perspective on Emerging energy Policy and Economic Research Agenda for Enabling Aviation Climate Action

06 November 2024

Read More

28

Emerging Energy Economics and Policy Research Priorities for Enabling the Electric Vehicle Sector

06 November 2024

Read More

28

Assessing the Impact of Energy Transition Initiatives on the Policy Cost of Saudi Arabia’s Net- Zero Ambition

05 November 2024

Saudi Arabia’s ambitious goal to achieve a net-zero economy by 2060 offers a unique opportunity for diversification away from fossil fuels while fostering long-term economic resilience and sustainability. Crucial to this transition are energy policies that steer the Kingdom from a fo...

Read More33

Can the Dangote Refinery Deliver on its Promise?

03 November 2024

In Nigeria, energy cost is the predominant driver of prices for all goods and services. With a population of over 200 million people, Nigeria is a member of the Organization of the Petroleum Exporting Countries (OPEC) and a major producer of crude oil in Africa.

Read More37

Lessons from an International Review of Successful and Unsuccessful Energy Subsidy Reforms

03 November 2024

Many factors contribute to the success of energy subsidy reform. To better understand these factors, we review studies that drew lessons from past attempts at reform. We synthesize the lessons and then expound on them by reviewing our newly constructed database of over 3,000 news art...

Read More35

Understanding the Causal Nexus Between Saudi’s Seaborne Trade and Economy and Quantifying the Relationship

03 November 2024

An economy’s primary objective is to foster high economic growth, ultimately enhancing the well-being of its citizens. Recent economic strategies have increasingly emphasized trade-oriented policies to achieve this goal.

Read More37

Financing the Decarbonization of Hard-to- Abate Sectors Trends, Issues, and Ways Forward

03 November 2024

Global transition investments have experienced incredible growth and progress, with the increasing level of participation from private actors in recent years. Investment flows in clean technologies have significantly increased since the COVID-19 era, reaching US$1.8 trillion in 2023,...

Read More31

Long-Term Forecasting Models of Oil Demand Emerging from the Global Petrochemical Sector

03 November 2024

This study aims to estimate the demand for petrochemical feedstocks for four main products (naphtha, ethane, liquified petroleum gas [LPG], and other petrochemical products) for each of the eight regions of the world.

Read More30

The Impact of Displacing Fuel Oil on Saudi Refineries

03 November 2024

Saudi Arabia aims to displace fuel oil in its electricity system and industry. Such a move will impact the operation of its oil refineries, and this commentary explores these potential effects.

Read More34

K-DSGE 2.0: A Dynamic Stochastic General Equilibrium Model for Saudi Arabia with Carbon Circular Economy Features

03 November 2024

This paper describes a substantially improved version of K-DSGE, the dynamic stochastic general equilibrium model of the Saudi Arabian economy, developed by KAPSARC researchers.

Read More33

Mitigating Climate Change While Producing More Oil: Economic Analysis of Government Support for CCS-EOR

01 November 2024

Read More

3

A Global Hydrogen Future

31 October 2024

Hydrogen is a significant part of energy conversations because of its scalability, flexibility, and decarbonization potential. Considerable efforts are underway globally to determine the most effective ways to introduce hydrogen into the energy mix. This report—A Global Hydrogen Futu...

Read More34

Using Satellite Technology to Measure Methane Emissions in Arabian Gulf Countries

30 October 2024

Decision makers need high-quality information on the level of greenhouse gas (GHG) emissions to take effective climate actions. Of the GHGs, methane can be particularly difficult to measure. Huge discrepancies exist in methane emission estimates at the global, national, and corporate...

Read More34

Unveiling the Causal Nexus Between Saudi’s Seaborne Trade and Economy: Evidence from an ARDL Model

21 October 2024

Read More

30

The Unfolding Potential of GCC China Collaboration on Critical Minerals

15 October 2024

As a clean energy system begins to be implemented worldwide, the demand for critical minerals is expected to increase dramatically in the coming decades. Thus, demonstrating how mineral collaboration benefits the economy is key to building long-term supply resilience and keeping the ...

Read More27

Are Automakers Overcharging Consumers for Electric Vehicle Batteries?

15 October 2024

Vehicle electrification is a major component of many sustainability goals and frameworks. Research suggests that battery costs account for a large portion of the price premium for electric vehicles (EVs) relative to internal combustion engine vehicles (ICEVs) and that price parity, w...

Read More32

KAPSARC Oil Market Outlook

15 October 2024

This quarter’s highlights include stagnating quarter-on-quarter (QoQ) oil demand, with a trivial decline of only 8,000 barrels a day (Kb/d), following last quarter’s growth of 1.27 million barrels per day (MMb/d). While significant gains and losses were reported in individual regions...

Read More29

Emissions Effect of Financial Development in the GCC: is The Effect Asymmetric?

14 October 2024

Read More

28

Unraveling the Black Market for Oil: The Complex Web of Phantom Trade and Its Reverberating Effects on Energy Security, Trade Balances, and Social Welfare

14 October 2024

for oil embodies the ancient parable of the blind men and the elephant. Just as the blind men each touched a different part of the elephant and experienced only a fraction of its true nature, so do policymakers perceive the black market for oil through narrow lenses. However, this m...

Read More28

Azerbaijan: Energy, Carbon, and Opportunities

14 October 2024

At the end of 2023, after prolonged discussions, Azerbaijan was selected as the host country of the 2024 United Nations climate summit, COP29. Like the two preceding hosts of COP28 and COP27, the United Arab Emirates (UAE) and Egypt, Azerbaijan is also a major oil and gas producer.

Read More38

Geothermal Energy – A Rising Powerhouse? A Global Technical Review and Applications for Saudi Arabia

14 October 2024

The Earth’s core, which is as hot as the sun, contains a large amount of thermal energy insulated by impermeable rocks. This energy, totaling 15 million zetta joules, dwarfs traditional energy sources such as coal and gas. However, only a fraction of this energy has been utilize...

Read More25

Facilitating the Low-Carbon Hydrogen Market: Opportunities, Challenges, and Pathways

14 October 2024

he hydrogen industry is at a turning point, as regulatory frameworks and incentive schemes begin to take shape. However, there are still barriers for market participants to commit to production projects and infrastructure, as they face the chicken-and-the-egg dilemma. The King Abdull...

Read More31

Enabling Net-Zero Shipping An Expert Review-Based Agenda for Emerging Techno-Economic and Policy Research

14 October 2024

Net-zero shipping is emerging as a global priority, underscored by the shipping sector’s increasing projected contribution to climate change, making it critical to understand the emerging associated research priorities. We outline key techno-economic and policy research priorities fo...

Read More11

Long-Term Forecasting Models of Oil Demand Emerging from the Global Petrochemical Sector

11 October 2024

Read More

27

Crafting Effective Climate, Energy, and Environmental Policy: Time For Action

11 October 2024

Read More

33

Saudi Arabia and the Circular Carbon Economy: From Vision to Implementation

06 October 2024

This case study shows how the Circular Carbon Economy (CCE) Index can be used to analyze a country’s CCE performance and enablers in a holistic manner and in a comparative context, relative to other countries. Saudi Arabia is an extremely relevant country to examine in this context g...

Read More40

Understanding the Role of Renewable Energy in Import Demand for Petrochemicals Is the Prevailing Perception More Imagined Than Real?

06 October 2024

The prevailing perception is that the transition to renewable energy will lead to a decrease in demand for hydrocarbons and petrochemicals. The present work empirically demonstrates that this common sense may be more imaginary than real: it finds evidence that the renewable energy ...

Read More28

Fueling India’s Mobility Transition: A Life Cycle Perspective on Passenger Road Transport Options

30 September 2024

The transportation sector is crucial for India’s economic and social development but poses significant environmental and global warming challenges. This study conducts a comprehensive Life Cycle Assessment (LCA) of passenger vehicles in India, evaluating various propulsion technologi...

Read More25

Gas Demand in the MENA Hydrocarbon- Producing Countries: Recent Trends and Drivers

30 September 2024

Middle East and North Africa ...MENA) region, with demand reaching more than 700 billion cubic meters (bcm) in 2022 and increasing by almost 50% compared with a decade ago. Gas demand in the MENA region accounts for 17% of the global gas consumption, making it a key demand center.

Read More39

Web-Based User Interfaces for Mathematical Models to Support Decisions: The Fuel Distribution Network Optimizer

30 September 2024

Mathematical models provide quantitative analyses that can inform policy decisions. We argue that two attributes can support models’ adoption by policymakers: an intuitive graphical interface and active engagement between modelers and policymakers.

Read More29

Climate and Cost Analysis of SUVs in Saudi Arabia A Life Cycle Analysis Approach

30 September 2024

This study is conducted within the framework of the Saudi Vision 2030 agenda to diversify its economy and promote sustainable technologies, specifically examining the life-cycle performance of hybrid and conventional sport utility vehicles (SUVs) in the Kingdom (KSA).

Read More34

Assessing the Potential and Feasibility of Carbon Dioxide Removal (CDR) Technologies in Saudi Arabia

30 September 2024

As the Kingdom of Saudi Arabia strives to achieve its climate goals and transition its economy away from fossil fuel dependency, understanding the viability and impact of carbon dioxide removal (CDR) options becomes paramount.

Read More32

The Path to 2060: Saudi Arabia’s Long-Term Pathway for GHG Emission Reduction

24 September 2024

Read More

38

Southeast Asia and the Circular Carbon Economy: A Rapidly Developing Region

12 September 2024

31

Middle East and North Africa and the Circular Carbon Economy: Seizing the Potential for Action

12 September 2024

The Middle East and North Africa (MENA) region is an emerging center of energy demand. Economic and population growth, increasing industrialization as well as rising living standards are all expected to contribute to a continued increase in the region’s energy consumption over the co...

Read More36

An Exposition of Bilinear “Implicit” Subsidy Equations

10 September 2024

The price-gap method is popularly applied to estimate energy subsidies, and it simply involves calculating the difference between the market and domestic prices of a good multiplied by the quantity consumed. In the case where subsidies impose foregone revenue rather than direct costs...

Read More27

Saudi Arabia’s Population Trends: Insights from the 2022 Census Revision

08 September 2024

Having people as a main focal point of all policies and activities worldwide and at an individual country level sets a responsibility for all countries/institutions to have reliable information on the size, structure, and dynamics of the population that can be used in provision of n...

Read More31

Are Households Quitting Electric Vehicle Ownership?

03 September 2024

In this paper, we investigate the proportion of U.S. plug-in electric vehicle (PEV) owners who discontinued PEV ownership by disposing of their PEV and buying a non-PEV as their next vehicle, which is termed PEV “discontinuance.”

Read More30

Emerging Policy and Economic Research Priorities for Enabling the Electric Vehicle Sector

01 September 2024

We highlight key emerging research priorities on the climate- and industrial-policy driven pathway to passenger car electrification, including both pure battery electric and plug-in hybrid electric vehicles, using a three-pronged approach. This includes examining journalistic reports...

Read More33

Emerging Research Priorities for Enabling Aviation Climate Action: Identification and Expert Evaluation

01 September 2024

Aviation climate action is emerging as a global priority, underscored by the aviation sector’s increasing projected contribution to climate change and the consequential effects of climate change on aviation operations. This makes it critical to understand the emergent associated rese...

Read More30

Green Jobs and the Saudi Gender Wage Gap: Explained and Unexplained

01 September 2024

Saudi Arabia has made great strides recently in increasing female labor force participation, reaching the Vision 2030 goal of 30% in late 2020, almost a decade early. With labor force participation achieved, the conversation now turns to labor market outcomes, and an increasing gende...

Read More31

Residential Electricity Consumption and Rebound Effects in Saudi Arabia: Insights into Bridging the Energy Efficiency Gap

01 September 2024

The rebound effect refers to the phenomenon where energy efficiency improvements lead to increased energy consumption, offsetting some of the expected energy savings. This article aims to estimate the direct rebound effect of residential electricity consumption in Saudi Arabia and ex...

Read More25

Climate Policy Stringency and Trade in Energy Transition Minerals: An Analysis of Response Patterns

01 September 2024

Read More

33

Are Automakers Overcharging Consumers for Electric Vehicle Batteries?

01 September 2024

Read More

26

The workshop participants voiced a number of diverse views about the prospects for future oil demand. They also clearly articulated the need for OPEC spare production capacity as a critical policy tool for the stabilization of world oil markets.

Read More29

The final COP28 agreement has set an ambitious target by calling for a doubling of the average annual rate of energy efficiency improvement by 2030. To achieve this goal, the current 2% improvement in energy efficiency needs to grow steadily, reaching and maintaining a growth rate of...

Read More24

Strategic Priorities and Cost Considerations for Decarbonizing Electricity Generation Using CCS and Nuclear Energy

26 August 2024

Read More

30

Net-zero Transport Dialogue: Emerging Developments and the Puzzles They Present

25 August 2024

Read More

30

The Dynamic Role of Subsidies in Promoting Global Electric Vehicle Sales

25 August 2024

Read More

30

Strategic Priorities and Cost Considerations for Decarbonizing Electricity Generation Using CCS and Nuclear Energy

25 August 2024

This paper investigates the economics of deploying carbon capture and storage (CCS) on gas-fired power plants while covering its entire value chain, i.e., carbon capture, transport, and storage, and conducting a thorough sensitivity scenario analysis. Our analysis shows that adopting...

Read More27

Energy is the vehicle that has enabled humanity to flourish. Since the dawn of time, humans have sought to find more efficient ways to power and propel their lives forward. With each generation, humanity has made progress in unlocking energy density, from burning wood to using fossil...

Read More28

Finding Opportunity in Economic Power Dispatch: Saving Fuels without Impacting Retail Electricity Prices in Fuel-producing Countries

20 August 2024

Read More

27

Assessing CCUS Potential for LNG in the GCC

14 August 2024

As the world experiences the energy transition, traditional oil and gas producers are feeling a greater need to decarbonize their hydrocarbon production.

Read More29

Bridging the Gaps for an Orderly Energy Transition: The Role of Sustainable Finance in Saudi Arabia

11 August 2024

As governments and organisations across the Middle East work towards achieving their net-zero agendas, sustainable finance plays a crucial role by raising capital for projects essential to achieving these targets. Robust capital markets, supportive regulatory frameworks, and tra...

Read More27

Measuring Green Jobs in Saudi Arabia: Saudis in Green Occupations

11 August 2024

This paper offers the first estimate of employment in Saudi Arabia that can be linked to the energy transition. Using a task-based taxonomy devised by the United States Bureau of Labor Statistics applied to detailed administrative data on Saudi workers, it is estimated that in 2022 a...

Read More37

Carbon Capture and Renewable Energy Policies: Could Policy Harmonization be a Puzzle Piece to Solve the Electricity Crisis?

01 August 2024

Read More

24

Are American Electric Vehicle Owners Quitting?

01 August 2024

Read More

32

The Future of Residential Electricity Demand in Saudi Arabia and the Role of Energy Efficiency in the 2060 Net Zero Pledge

25 July 2024

Abstract Saudi Arabia has set the ambitious goal to reach net zero by 2060, and reducing domestic electricity consumption and thus curbing greenhouse gas (GHG) emissions is critical. Since the residential sector is the biggest consumer of electricity in the Kingdom, understanding how...

Read More26

Modelling and Projecting Regional Electricity Demand for Saudi Arabia

17 July 2024

Read More

23

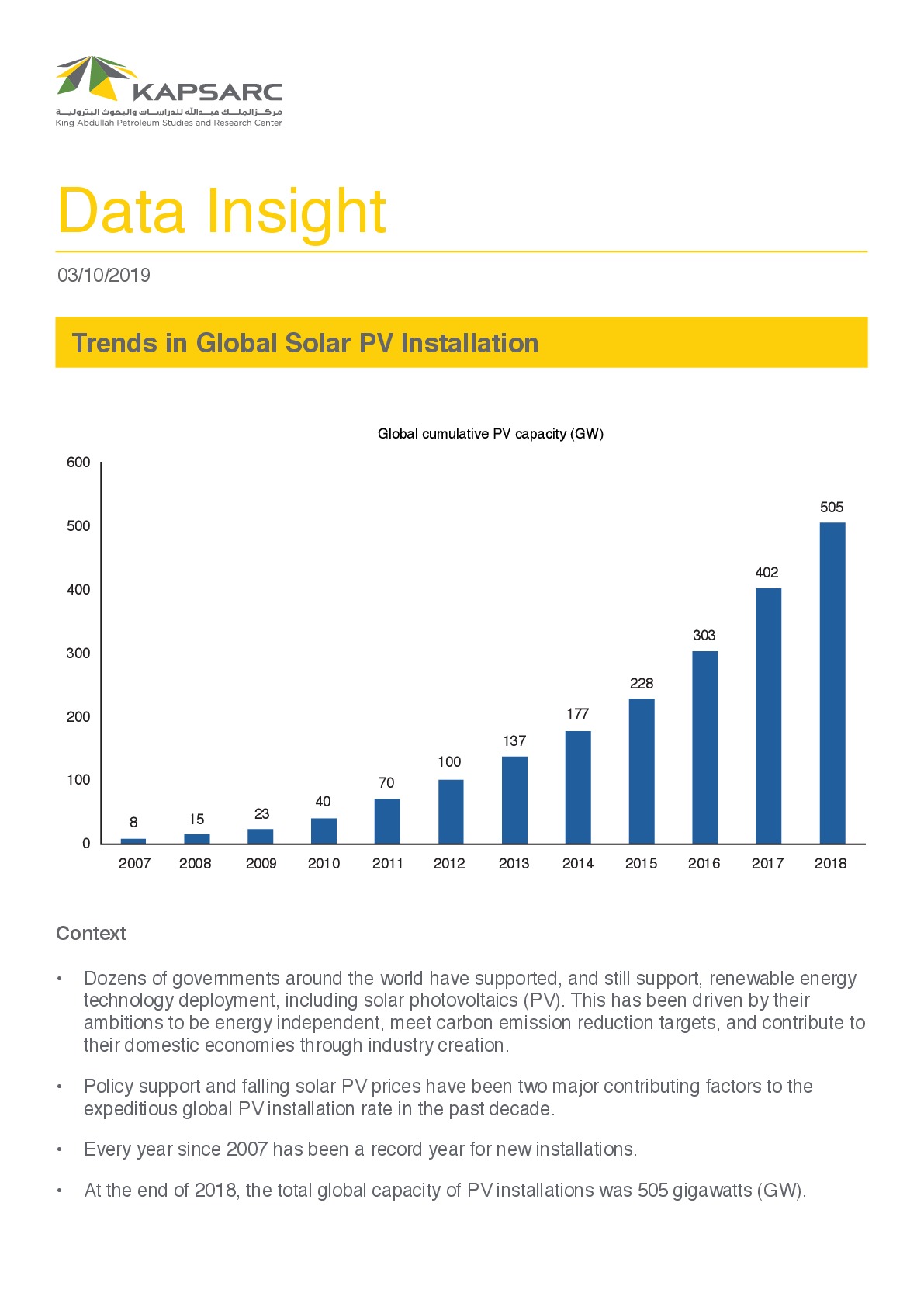

Trends in Global Solar Photovoltaic Installation in 2023

16 July 2024

In 2023, global solar photovoltaic (PV) capacity increased by a record 407 gigawatts (GW) and brought the total global cumulative installed PV capacity to 1,589 GW at the end of 2023.

Read More33

Impacts of Ride-Hailing on Energy and the Environment: A Systematic Review

15 July 2024

Ride-hailing has expanded substantially around the globe over the last decade and is likely to be an integral part of future transportation systems. Through a systematic review of the literature concerning the energy and environmental impacts of ride-hailing, we have identified a dic...

Read More31

Nudging Toward Sustainability: Behavioral Interventions in Saudi Arabia’s Residential Electricity Consumption

08 July 2024

sidential energy consumption is responsible for significant global energy consumption and associated emissions. As a result, households are a prime focus for behavior-modifying interventions. Household energy conservation can be achieved through changes in consumption patterns and in...

Read More30

The Role and Deployment Timing of Direct Air Capture in the Kingdom of Saudi Arabia’s Net-Zero Transition

08 July 2024

The Kingdom of Saudi Arabia (KSA) has pledged to achieve net-zero greenhouse gas (GHG) emissions by 2060. Direct air carbon capture and storage (DACCS) is critical for the country to meet its net-zero target given its reliance on fossil fuels and limited options for ...2) removal (CDR).

Read More35

Aviation Challenges in the Long Term: Technological Developments, Energy Transition, and Climate Change

08 July 2024

The aviation sector, known for its significant emission levels, is facing a...2 emissions, presents challenges across the short-, medium-, and long-term horizons. As a result, there is a growing focus on addressing the environmental impact of aviation and adopting sustainable practices.

Read More26

An Emerging Framework for the Probabilistic Cost- Benefit Analysis of the Reliability, Resiliency, and Adaptability of Electric Power Systems

07 July 2024

Probabilistic cost-benefit analyses of the reliability, resiliency, and adaptability of electric power systems can inform policymakers on how to efficiently reduce the frequency, magnitude, duration, and costs of power outages; how to cost-effectively improve the integration of varia...

Read More38

Framework for Leveraging the Digitalization of Power Systems within the Context of Energy Transition

07 July 2024

The digitalization of power systems can contribute to a smoother energy transition by, for example, maximizing the use of renewable energy (RE; i.e., minimizing curtailment), peak shaving, and relaxing grid congestion. Collectively, these and other benefits play an important role in ...

Read More27

Can Smart Cities Be Sustainable: An Emerging Field of Research

07 July 2024

Research on smart sustainable cities (SSCs) has fueled a rapid expansion of scholarly work in recent years. However, the key trends and future research avenues in this field are still ambiguous. This article examines the content of SSC research by conducting network and bibliometric ...

Read More30

Energy Efficiency Trends in Saudi Arabian Commercial Aviation before and after COVID-19

01 July 2024

Read More

28

Driving Reductions in Emissions: Unlocking the Potential of Fuel Economy Targets in Saudi Arabia

01 July 2024

The adoption of more stringent fuel economy standards represents a pivotal pathway toward achieving net zero emissions in the transportation sector. By steadily increasing the fuel efficiency of vehicles, this approach drives a gradual but consistent decline in emissions. When couple...

Read More31

Carbon Capture, Utilization, and Storage (CCUS) Solutions to Decarbonize LNG: Why, Where and How Much?

01 July 2024

In 2019, a new product – carbon-neutral LNG – was born. By 2021, the market for this product had grown rapidly. However, in 2022, the number of announcements about the volumes delivered to customers significantly decreased. To a large extent, this decrease was linked to credibility i...

Read More29

KEMGEv2: A General Equilibrium Model for Least-Cost Net Zero Emission Pathways in Saudi Arabia

01 July 2024

This paper describes a novel, dynamic, forward-looking applied general equilibrium model of Saudi Arabia that represents interactions between the energy sectors and the rest of the economy. This model serves to produce long-term scenarios that describe possible energy transition traj...

Read More34

Reaching Net-Zero GHG Emissions in Saudi Arabia by 2060: Transformation of the Industrial Sector

30 June 2024

The industrial sector plays a crucial role in the economy of the Kingdom of Saudi Arabia (KSA). Its energy consumption primarily relies on natural gas and oil due to the abundance of these resources and their relatively low administered prices. To reduce oil dependence and create a m...

Read More35

he global energy landscape is undergoing a profound transformation driven by the urgent need to mitigate climate change and transition toward a sustainable, low-carbon future. The development and deployment of carbon capture and storage (CCS) and hydrogen technologies are gaining tra...

Read More27

Accelerating Climate Finance for Saudi Arabia’s Net Zero Ambitions: Green Financing Frameworks

27 June 2024

As part of the global climate agenda, the Kingdom of Saudi Arabia (KSA) is committed to achieving net zero greenhouse gas (GHG) emissions by 2060 through the Circular Carbon Economy (CEE) approach. To achieve this goal, the Kingdom aims to involve private investors more and advance i...

Read More33

NOCs and ESG: Room for Refinement?

24 June 2024

The oil and gas industry has faced investment challenges since 2014. Oil and gas suppliers are still searching for a solution to attract investments from financial institutions and other cautious investors who are hesitant to inject more capital. Factors such as price volatility, unc...

Read More28

Decarbonizing Saudi Arabia’s Residential Sector: Designing Behavioral Interventions for Efficient and Sustainable Energy Consumption

24 June 2024

There is a consensus in the literature regarding the significant role of behavioral change in reducing the level of residential energy consumption. However, there is an ongoing debate concerning the most effective mechanisms and instruments with which to promote energy-efficient acti...

Read More29

Projecting Saudi Arabia’s CO2 Dynamic Baselines to 2060: A Multivariate Approach

12 June 2024

Using an econometric model, we generate scenario projections of CO2 emissions under different sets of assumptions on the underlying drivers. These drivers include GDP, the energy price, economic structure, and the underlying emissions trend. Our baseline scenario projects that Saudi ...

Read More25

How Can Bilateral Contracts Support Electricity Trade? A Regional Electricity Model Perspective for the GCC Plus Egypt, Jordan, and Iraq

11 June 2024

Cross-border electricity trading in the Middle East and North Africa (MENA) can provide cost and environmental benefits. However, for historical reasons, electricity trading has not reached a mature stage in this region. Based on a bespoke economic dispatch model for the 2030 horizon...

Read More28

Impacts of Regional Electricity Demand in Saudi Arabia A Study of the Government Sector

05 June 2024

This research presents a comprehensive analysis of electricity demand factors in Saudi Arabia, focusing on the government sector across different regions.

Read More30

Energy Transition in Oil-Dependent Economies: Public Discount Rates for Investment Project Evaluation

05 June 2024

The selection of welfare-enhancing projects necessitates the determination of the present value of cash flows from a public policy perspective. For an oil-exporting economy, the domestic energy transition often implies displacing oil from domestic consumption. Economic dependence on ...

Read More30

Closing the Efficiency Gap: Insights into curbing the direct rebound effect of residential electricity consumption in Saudi Arabia

04 June 2024

Read More

31

Which Bioenergy with Carbon Capture and Storage (BECCS) Pathways Can Provide Net-negative Emissions?

01 June 2024

Read More

27

Beyond Efficiency Gains: Addressing the Rebound Effect in Saudi Arabian Residential Cooling

01 June 2024

Read More

29

Resilience of Saudi Arabia’s Economy to Oil Shocks: Effects of Economic Reforms

30 May 2024

We assess the extent to which the implementation of Vision 2030 policies enhances the Saudi economy’s resilience to oil shocks. Using a dynamic stochastic general equilibrium model that captures the country’s economic diversification policies, we build a resilience index based on imp...

Read More33

Managing the Oil Market Under Misinformation: A Reasonable Quest?

28 May 2024

This paper examines the type and quality of information that OPEC needs to stabilize the oil market. We extend our previous structural model, in which OPEC makes potential mistakes in judging the size of market shocks, to now include the possibility that OPEC misestimates how the mar...

Read More30

The worldwide endeavor to achieve a low-carbon, sustainable economic future via energy transition technologies emphasizes the significant need for minerals and materials.

Read More27

How the U.S. Inflation Reduction Act Supports Energy Efficiency and Low-Carbon Buildings

27 May 2024

The U.S. Inflation Reduction Act (IRA) recognizes that buildings account for a significant share of U.S. energy consumption and greenhouse gas emissions. To address this issue, the IRA includes a range of policies and programs to make energy efficiency and conservation measures more ...

Read More28

Toward Just Transitions in the MENA Region: Insights from the 2022 Circular Carbon Economy Index

23 May 2024

In recent years, it has become increasingly evident that any major effort to reduce emissions will require a whole-of-society approach that brings along people equally within and across countries. As a sign of this notion entering the “mainstream” of global climate governance, a just...

Read More28

The New Oil Market Multiverse: Physical Commodity Swaps as Instruments for Circumventing Sanctions and Their Implications for the Global Economy

23 May 2024

From the global pandemic to the aftershocks of the COVID-19 pandemic and the war in Ukraine, the past few years have witnessed a reordering of global trade flows, most dramatically in the energy sector. Less obviously, these shifts have also precipitated an emerging trend toward alte...

Read More30

European Gas Supply Diversification: What Is the Role of Middle Eastern and African Liquefied Natural Gas?

23 May 2024

This paper investigates the role of the Middle East and Africa (MEA) in supplying liquefied natural gas (LNG) to Europe in the context of sustained Russian gas pipeline disruptions.

Read More29

Forecasting Saudi Arabia’s Non-Oil GDP Using a Bayesian Mixed Frequency VAR

23 May 2024

Bayesian vector autoregressions have been used by central banks to prepare short-term projections of quarterly GDP and other macroeconomic variables. The Bayesian approach offers the advantage that a researcher can use a priori knowledge to specify a prior distribution of the paramet...

Read More30

KAPSARC Oil Market Outlook

14 May 2024